What is SuperTrend?

The SuperTrend indicator is a popular trend-following system that plots a line on the price chart, dynamically switching its position relative to the price. It's built upon the concept of Average True Range (ATR), which measures market volatility. This makes SuperTrend adaptive to changing market conditions, providing more reliable signals than indicators with fixed distances from price.

In Pine Script, SuperTrend is a robust tool for identifying trends, generating buy/sell signals, and even for setting dynamic stop-loss levels.

Components and Calculation

SuperTrend primarily consists of two key components:

- ATR Period: The look-back period for calculating the Average True Range (e.g., 10 periods).

- Multiplier (Factor): A value that determines the distance of the SuperTrend line from the price (e.g., 3).

The indicator calculates an upper and lower basic band, and then switches between them based on price action. The core calculation involves:

- Calculating ATR: Measures the average volatility over the specified period.

- Basic Upper Band: `(high + low) / 2 + (multiplier * ATR)`

- Basic Lower Band: `(high + low) / 2 - (multiplier * ATR)`

- Final SuperTrend Line: The line switches based on whether the closing price crosses the basic bands, reflecting the prevailing trend. When price closes above the upper band, SuperTrend flips below price; when price closes below the lower band, it flips above price.

Basic SuperTrend Implementation in Pine Script

Pine Script v5 provides a convenient built-in function `ta.supertrend()` that handles all the calculations for you.

//@version=5

indicator("My SuperTrend Indicator", overlay=true)

// Inputs for SuperTrend parameters

atrPeriod = input(10, title="ATR Length")

factor = input.float(3.0, title="Factor")

// Calculate SuperTrend using the built-in function

[supertrend, direction] = ta.supertrend(factor, atrPeriod)

// Plot the SuperTrend line, coloring it based on its direction

plot(supertrend, title="SuperTrend", color=direction < 0 ? color.green : color.red, linewidth=2)

// Optional: Plot arrows when the trend changes

plotshape(direction == 1 and direction[1] == -1, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

plotshape(direction == -1 and direction[1] == 1, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

Practical SuperTrend Strategies

1. Trend Following with SuperTrend

SuperTrend excels at identifying and following trends. When the SuperTrend line is below the price, it indicates an uptrend (often colored green). When it's above the price, it indicates a downtrend (often colored red).

//@version=5

strategy("SuperTrend Trend Following", overlay=true)

// Inputs

atrPeriod = input(10, title="ATR Length")

factor = input.float(3.0, title="Factor")

// Calculate SuperTrend

[supertrend, direction] = ta.supertrend(factor, atrPeriod)

// Entry conditions based on SuperTrend direction change

longCondition = ta.crossover(close, supertrend) // Price crosses above SuperTrend

shortCondition = ta.crossunder(close, supertrend) // Price crosses below SuperTrend

// Strategy entries

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Plot SuperTrend

plot(supertrend, title="SuperTrend", color=direction < 0 ? color.green : color.red, linewidth=2)

2. SuperTrend as a Dynamic Stop-Loss

One of SuperTrend's most powerful applications is as a dynamic stop-loss. The indicator's line itself can serve as a trailing stop, adapting to market volatility. When in a long position, the SuperTrend's green line (uptrend) acts as your stop. When in a short position, the red line (downtrend) acts as your stop.

//@version=5

strategy("SuperTrend Dynamic Stop-Loss", overlay=true)

// Inputs

atrPeriod = input(10, title="ATR Length")

factor = input.float(3.0, title="Factor")

// Calculate SuperTrend

[supertrend, direction] = ta.supertrend(factor, atrPeriod)

// Entry conditions (example: simple moving average crossover for entries)

fastMA = ta.ema(close, 20)

slowMA = ta.ema(close, 50)

longEntry = ta.crossover(fastMA, slowMA)

shortEntry = ta.crossunder(fastMA, slowMA)

// Long strategy

if (longEntry)

strategy.entry("Buy", strategy.long)

// Short strategy

if (shortEntry)

strategy.entry("Sell", strategy.short)

// Dynamic Stop Loss based on SuperTrend

// If in a long position, close if price crosses below SuperTrend

if (strategy.position_size > 0)

strategy.exit("Long Exit", from_entry="Buy", stop=supertrend)

// If in a short position, close if price crosses above SuperTrend

if (strategy.position_size < 0)

strategy.exit("Short Exit", from_entry="Sell", stop=supertrend)

// Plot SuperTrend

plot(supertrend, title="SuperTrend", color=direction < 0 ? color.green : color.red, linewidth=2)

Optimizing SuperTrend Performance

To maximize SuperTrend's effectiveness:

- Parameter Tuning: Experiment with `atrPeriod` and `factor` for different timeframes and assets. A shorter ATR period makes it more sensitive; a smaller factor brings the line closer to price.

- Multi-Timeframe Analysis: Use SuperTrend on a higher timeframe to confirm the overall trend, and on a lower timeframe for entry/exit signals.

- Combine with Volume: Look for volume confirmation on SuperTrend signals. A trend reversal accompanied by significant volume often provides a stronger signal.

- Confluence with Support/Resistance: SuperTrend signals that align with key support or resistance levels can be more reliable.

Common SuperTrend Pitfalls

- Whipsaws in Ranging Markets: SuperTrend performs best in trending markets. In choppy or sideways markets, it can generate numerous false signals.

- Lagging Indicator: Like other trend-following indicators, SuperTrend can sometimes lag price action, especially during sharp reversals.

- Not a Standalone Indicator: Relying solely on SuperTrend without additional confirmation from other indicators or price action can lead to poor results.

- Over-Optimization: Excessive tuning of parameters to historical data may not translate to future performance.

Conclusion

The SuperTrend indicator is an exceptional tool for traders seeking a dynamic, volatility-adjusted way to identify and follow trends in Pine Script. Its intuitive visual signals and utility as a stop-loss mechanism make it a valuable addition to any TradingView strategy. By understanding its ATR-based calculations and combining it wisely with other analytical tools, you can harness the full power of SuperTrend to navigate market movements more effectively.

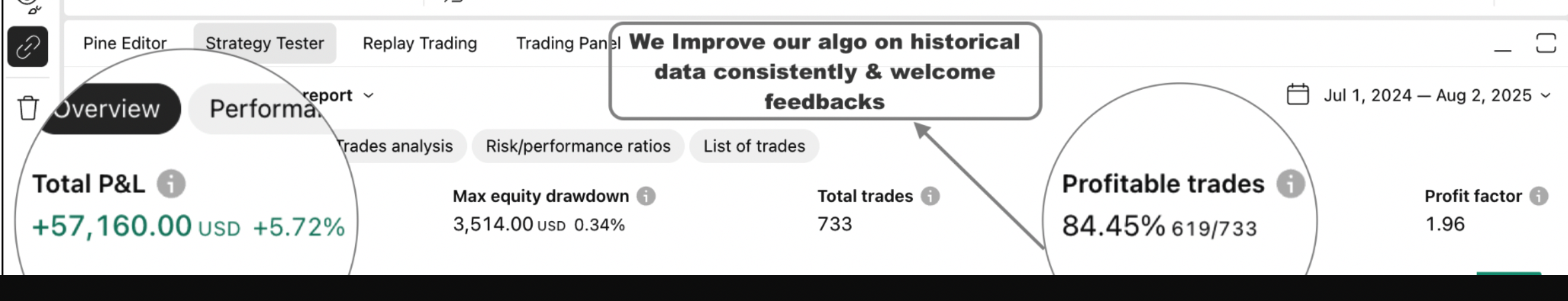

Enhance Your Trading

Get a high-performance Pine Script analysis tool for actionable market insights, designed for traders on the move.

This strategy runs in live mode on TradingView, helping you identify potential opportunities.

⭐⭐⭐ 500+ Clients Helped | 💯 100% Satisfaction Rate

Get Pine Script Strategy

Get Pine Script Strategy