What are Bollinger Bands?

Bollinger Bands (BB) are a widely popular and versatile technical analysis indicator developed by John Bollinger. They consist of three lines:

- A Middle Band: Typically a 20-period Simple Moving Average (SMA) of the price.

- An Upper Band: Plotted a certain number of standard deviations (typically 2) above the Middle Band.

- A Lower Band: Plotted the same number of standard deviations below the Middle Band.

The key feature of Bollinger Bands is their dynamic nature: they expand during periods of high market volatility and contract during periods of low volatility. This adaptability makes them valuable for identifying overbought/oversold conditions relative to the moving average, potential trend reversals, and impending price breakouts following periods of consolidation.

In Pine Script, Bollinger Bands are a fundamental tool for traders seeking to understand price volatility and leverage mean-reversion or breakout strategies.

Components and Calculation

The calculation of Bollinger Bands involves a Simple Moving Average (SMA) and Standard Deviation (StdDev) of price:

- Middle Band: A Simple Moving Average of the `close` price over a specified `length` (e.g., 20 periods).

`Middle Band = SMA(close, length)` - Standard Deviation: Calculate the standard deviation of the `close` price over the same `length`. Standard deviation measures how dispersed the data points are from their average.

`StdDev = ta.stdev(close, length)` - Upper Band: Add a multiple of the standard deviation to the Middle Band. The `multiplier` is typically 2.

`Upper Band = Middle Band + (StdDev * multiplier)` - Lower Band: Subtract the same multiple of the standard deviation from the Middle Band.

`Lower Band = Middle Band - (StdDev * multiplier)`

Approximately 95% of price action is expected to occur within the Upper and Lower Bands when using a 2-standard deviation setting.

Basic Bollinger Bands Implementation in Pine Script

Pine Script v5 provides a convenient built-in function `ta.bb()` for calculating Bollinger Bands.

//@version=5

indicator("My Bollinger Bands", overlay=true) // overlay=true to plot directly on the price chart

// Inputs for Bollinger Bands parameters

length = input.int(20, title="BB Length", minval=1)

stdDevMultiplier = input.float(2.0, title="StdDev Multiplier", minval=0.1, step=0.1)

// Calculate Bollinger Bands using the built-in function

// ta.bb returns the Middle, Upper, and Lower bands

[middleBand, upperBand, lowerBand] = ta.bb(close, length, stdDevMultiplier)

// Plot the Middle Band

plot(middleBand, title="Middle Band", color=color.blue, linewidth=2)

// Plot the Upper and Lower Bands

plot(upperBand, title="Upper Band", color=color.red, linewidth=1)

plot(lowerBand, title="Lower Band", color=color.green, linewidth=1)

// Fill the area between the bands for visual appeal

fill(upperBand, lowerBand, color=color.new(color.blue, 90), title="BB Background")

Practical Bollinger Bands Trading Strategies

1. Bollinger Band Squeeze (Volatility Contraction)

A "squeeze" occurs when the bands contract significantly, indicating a period of low volatility and consolidation. This often precedes a period of high volatility and a strong price breakout.

- Signal: Bands narrow considerably, often becoming the tightest they've been in a while.

- Trade Action: Wait for price to break out of the consolidation phase. A close above the Upper Band after a squeeze suggests a bullish breakout; a close below the Lower Band suggests a bearish breakout. Combine with volume for confirmation (higher volume on breakout).

//@version=5

strategy("Bollinger Band Squeeze Breakout", overlay=true)

length = input.int(20, title="BB Length", minval=1)

stdDevMultiplier = input.float(2.0, title="StdDev Multiplier", minval=0.1, step=0.1)

[middleBand, upperBand, lowerBand] = ta.bb(close, length, stdDevMultiplier)

plot(middleBand, "Middle Band", color.blue)

plot(upperBand, "Upper Band", color.red)

plot(lowerBand, "Lower Band", color.green)

fill(upperBand, lowerBand, color.new(color.blue, 90))

// Calculate band width relative to middle band for squeeze detection

bandWidth = (upperBand - lowerBand) / middleBand * 100

// Detect a squeeze (e.g., current width is historically low)

// We'll use a simple threshold or look for the lowest width over a longer period

squeezeThreshold = input.float(5.0, title="Squeeze Percentage Threshold", minval=0.1, step=0.1) // Adjust based on asset

isSqueezing = bandWidth < squeezeThreshold

// Entry after squeeze break

longBreakout = isSqueezing[1] and close > upperBand and close[1] <= upperBand[1]

shortBreakout = isSqueezing[1] and close < lowerBand and close[1] >= lowerBand[1]

if (longBreakout)

strategy.entry("Long Breakout", strategy.long)

if (shortBreakout)

strategy.entry("Short Breakout", strategy.short)

// Example exit: close on touch of opposite band or after a set number of bars

strategy.exit("Long Exit", from_entry="Long Breakout", stop=lowerBand, limit=middleBand + (upperBand - middleBand) * 0.5) // Exit at middle band or stop loss

strategy.exit("Short Exit", from_entry="Short Breakout", stop=upperBand, limit=middleBand - (middleBand - lowerBand) * 0.5)

2. Band Walks (Trend Following)

In strong trends, price can "walk" along the Upper or Lower Band without touching the Middle Band for extended periods. This indicates strong directional momentum.

- Bullish Walk: Price consistently touches or rides the Upper Band, and the Middle Band is sloping upwards. Pullbacks often find support at the Middle Band.

- Bearish Walk: Price consistently touches or rides the Lower Band, and the Middle Band is sloping downwards. Rallies often find resistance at the Middle Band.

//@version=5

strategy("Bollinger Band Walk Strategy", overlay=true)

length = input.int(20, title="BB Length", minval=1)

stdDevMultiplier = input.float(2.0, title="StdDev Multiplier", minval=0.1, step=0.1)

[middleBand, upperBand, lowerBand] = ta.bb(close, length, stdDevMultiplier)

plot(middleBand, "Middle Band", color.blue)

plot(upperBand, "Upper Band", color.red)

plot(lowerBand, "Lower Band", color.green)

fill(upperBand, lowerBand, color.new(color.blue, 90))

// Conditions for a bullish walk (simple example)

isBullishWalk = close > middleBand and close > close[1] and close[1] > middleBand[1] and middleBand > middleBand[1] and close >= upperBand

// Conditions for a bearish walk

isBearishWalk = close < middleBand and close < close[1] and close[1] < middleBand[1] and middleBand < middleBand[1] and close <= lowerBand

if (isBullishWalk)

strategy.entry("Riding Bull", strategy.long)

if (isBearishWalk)

strategy.entry("Riding Bear", strategy.short)

// Exit when price breaks the walk or hits middle band

strategy.close("Riding Bull", when=close < middleBand or close[1] < middleBand[1])

strategy.close("Riding Bear", when=close > middleBand or close[1] > middleBand[1])

3. Mean Reversion (Band Bounces)

In sideways or consolidating markets, price often reverts to the Middle Band after touching one of the outer bands. This strategy attempts to capitalize on these "bounces."

- Buy Signal: Price touches or penetrates the Lower Band, and then closes back inside the band, especially if combined with a bullish candlestick pattern.

- Sell Signal: Price touches or penetrates the Upper Band, and then closes back inside the band, especially if combined with a bearish candlestick pattern.

//@version=5

strategy("Bollinger Band Mean Reversion", overlay=true)

length = input.int(20, title="BB Length", minval=1)

stdDevMultiplier = input.float(2.0, title="StdDev Multiplier", minval=0.1, step=0.1)

[middleBand, upperBand, lowerBand] = ta.bb(close, length, stdDevMultiplier)

plot(middleBand, "Middle Band", color.blue)

plot(upperBand, "Upper Band", color.red)

plot(lowerBand, "Lower Band", color.green)

fill(upperBand, lowerBand, color.new(color.blue, 90))

// Identify if the market is ranging (e.g., band width is not too wide and not too narrow)

// This is a simplification; a dedicated choppiness index might be better

isRanging = (upperBand - lowerBand) / middleBand * 100 > 1.0 and (upperBand - lowerBand) / middleBand * 100 < 5.0

// Buy when close touches lower band and closes back inside, confirming mean reversion

longReversion = isRanging and close > lowerBand and close[1] <= lowerBand[1]

// Sell when close touches upper band and closes back inside

shortReversion = isRanging and close < upperBand and close[1] >= upperBand[1]

if (longReversion)

strategy.entry("Buy Reversion", strategy.long)

if (shortReversion)

strategy.entry("Sell Reversion", strategy.short)

// Exit at Middle Band (target) or if price goes against you

strategy.close("Buy Reversion", when=close > middleBand or close < lowerBand)

strategy.close("Sell Reversion", when=close < middleBand or close > upperBand)

Optimizing Bollinger Bands Performance

To get the most from Bollinger Bands in Pine Script:

- Parameter Tuning:

- `Length` (SMA period): The standard 20 is suitable for intermediate-term analysis. Shorter lengths make bands more reactive (good for short-term trading); longer lengths make them smoother (better for longer-term trends).

- `StdDev Multiplier`: The standard 2.0 covers approximately 95% of price moves. A lower multiplier (e.g., 1.5) will make bands tighter, generating more signals but also more false signals. A higher multiplier (e.g., 2.5 or 3.0) will make bands wider, providing fewer but potentially more reliable signals.

- Combine with Other Indicators: Bollinger Bands are best used with other indicators.

- Momentum Oscillators (RSI, Stochastic, MACD): To confirm overbought/oversold conditions when price hits a band, or divergence.

- Volume Indicators (MFI, OBV): To confirm breakouts from squeezes or validate reversals.

- Trend-Following Indicators (ADX, Moving Averages): To confirm the underlying trend, helping to differentiate between mean-reversion and trend-following opportunities.

- Adapt to Market Conditions: Understand that mean-reversion strategies work best when volatility is relatively low and the market is ranging (bands are narrower). Trend-following (band walks/breakouts) works best when volatility is increasing and a strong trend is forming (bands are expanding).

- Look for W-Bottoms and M-Tops: These are classic Bollinger Band patterns where price makes a new low/high outside the bands, but the subsequent move back inside (and often a retest that doesn't breach the low/high) signals a reversal. This requires pattern recognition.

Common Bollinger Bands Pitfalls

- False Signals in Strong Trends: In a strong uptrend, price can consistently "walk" along the Upper Band. Treating every touch of the Upper Band as a sell signal in such a trend will lead to premature exits or missed profits. The same applies to downtrends and the Lower Band.

- Whipsaws in Choppy Markets: While designed to adapt, in very choppy or non-directional markets, the bands can still generate false reversal signals, leading to whipsaws.

- Lag: As Bollinger Bands are based on a moving average and standard deviation, they are lagging indicators. They reflect past price action and volatility.

- Over-Reliance on Single Signals: Relying solely on price touching a band without confirmation from other indicators or price action analysis can be detrimental.

- Not a Standalone Indicator: Bollinger Bands are a powerful tool but should not be used in isolation. They perform best as part of a comprehensive trading system.

Conclusion

Bollinger Bands are an exceptionally powerful and dynamic technical analysis tool in Pine Script for TradingView. By creating a visual representation of price volatility around a central moving average, they provide traders with invaluable insights into relative overbought/oversold conditions, potential trend reversals, and shifts in market volatility. Whether you are looking to capitalize on volatility squeezes, ride strong trends, or execute mean-reversion strategies, understanding and effectively applying Bollinger Bands, ideally in conjunction with other indicators and robust risk management, can significantly enhance your trading decisions and overall performance.

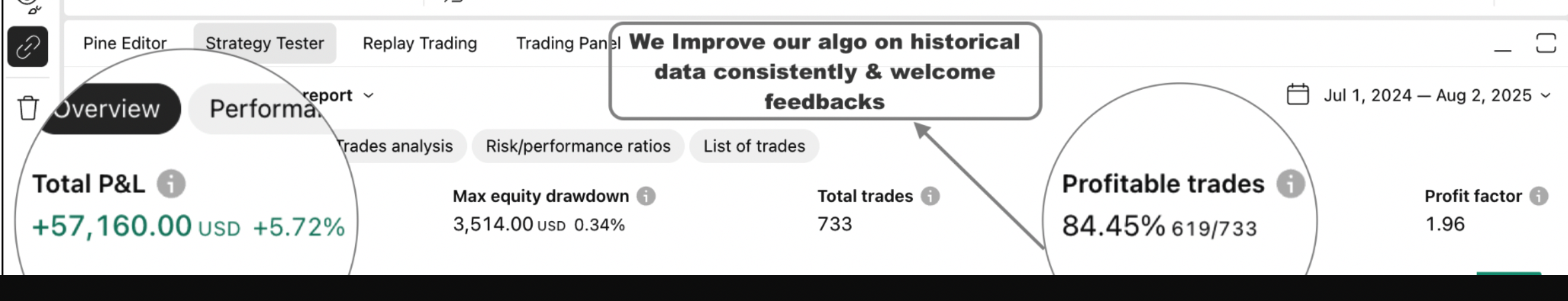

Enhance Your Trading

Get a high-performance Pine Script analysis tool for actionable market insights, designed for traders on the move.

This strategy runs in live mode on TradingView, helping you identify potential opportunities.

⭐⭐⭐ 500+ Clients Helped | 💯 100% Satisfaction Rate

Get Pine Script Strategy

Get Pine Script Strategy